Medicare Advantage Plans - Available

Options in this Area

Types of Insurance Available

for Seniors:

•

Medicare Only

–

You pay Medicare Part B fee

–

You pay 20% of doctors charges

–

You pay hospital deductible

–

You pay for prescription drugs

•

Medicare Supplement Plans + Separate

Prescription Drug Plans (Part D)

–

Jerry covered this

•

Medicare Advantage Plans (Part C)

–

The insurance company operates as a contractor

for Medicare

–

The plans usually cover both medical and drug

costs

–

You use a single private insurance card

–

You pay a “copay” when you visit the doctor and

receive no bill

–

The plans pay doctors and hospitals at Medicare

rates

–

You still have to pay the Medicare Part B premium

Medicare Advantage Plans:

•

Health Maintenance Organization (HMO) Plans

•

Preferred Provider Organization (PPO) Plans

•

Point Of Service (POS) Plans

•

Private Fee-for-Service (PFFS) Plans

•

Special Needs Plans (SNP)

•

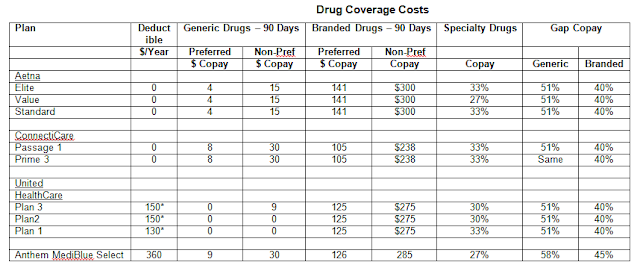

Only HMO, PPO, and POS Plans with prescription

drug coverage are covered in the attached table because they are relevant to

most seniors in this group

HMO vs PPO/POS

•

An HMO provides full coverage for only a fixed

network of doctors and hospitals

–

Network covers part or all of a single state

only

•

A PPO or

POS provides coverage for

–

A fixed network of doctors and hospitals, plus

–

Doctors and hospitals outside the network

•

PPO and POS costs may be significantly higher

for doctors and hospitals outside the network

–

Copays

–

Maximum out-of-pocket costs

–

Deductibles

HMO Plans:

•

Aetna

–

Medicare Elite Plan

–

Medicare Value Plan

–

Medicare Standard Plan

•

ConnectiCare

–

Passage 1

–

Choice 3

•

United Health Care

–

MedicareComplete Plan 3

–

MedicareComplete Plan 2

–

MedicareComplete Plan 1

•

Anthem

–

MediBlue Select

PPO Plans:

•

Aetna

–

Medicare Standard Plan

•

United Health Care

–

AARP MedicareComplete Choice

POS Plans

•

ConnectiCare

–

Flex 3

–

Flex 1